Filter by

The language used throughout the course, in both instruction and assessments.

908 results for "tax"

Skills you'll gain: Finance, Leadership and Management, Planning, Risk Management, Financial Management, Cash Management, Accounting, Taxes

University of Illinois at Urbana-Champaign

Skills you'll gain: Accounting, Taxes

Skills you'll gain: Leadership and Management

Status: Free

Status: FreeUniversity of Pennsylvania

Skills you'll gain: Culture

Queen Mary University of London

Skills you'll gain: Cloud Computing, Taxes

Status: Free

Status: FreeUniversity of Pennsylvania

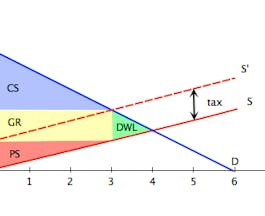

Skills you'll gain: Problem Solving, Market Analysis, Behavioral Economics, Business Analysis, Decision Making, Finance, Market Research, Mathematics, Econometrics

PwC India

Skills you'll gain: Finance, Problem Solving

Erasmus University Rotterdam

University of Minnesota

Skills you'll gain: Leadership and Management, Market Research, Research and Design, Clinical Data Management, Innovation, Market Analysis, Finance, Business Analysis, Data Management, Entrepreneurship, Organizational Development, Regulations and Compliance, Risk Management, Strategy and Operations, Data Analysis, Human Resources, Marketing, Payments, Design and Product, People Development, Product Development

Interactive Brokers

Skills you'll gain: Finance, Financial Analysis, Investment Management, Leadership and Management, Risk Management, Financial Management, Market Analysis, Securities Sales, Securities Trading, Taxes

PwC India

Skills you'll gain: Leadership and Management, Taxes, Problem Solving

Columbia University

Skills you'll gain: Finance, Leadership and Management, Project Management, Financial Analysis, Investment Management, Financial Accounting, Financial Management, Budget Management, Risk Management, Strategy and Operations

Searches related to tax

In summary, here are 10 of our most popular tax courses

- The Fundamentals of Personal Finance: SoFi

- Taxation of Business Entities II: Pass-Through Entities: University of Illinois at Urbana-Champaign

- GST - Audit, assessment and litigation: PwC India

- Greek and Roman Mythology: University of Pennsylvania

- Cloud Computing Law: Law Enforcement, Competition, & Tax: Queen Mary University of London

- Microeconomics: The Power of Markets: University of Pennsylvania

- GST - Using input tax credit: PwC India

- Introduction to Economic Theories: Erasmus University Rotterdam

- Healthcare Marketplace: University of Minnesota

- U.S. Bond Investing Basics: Interactive Brokers